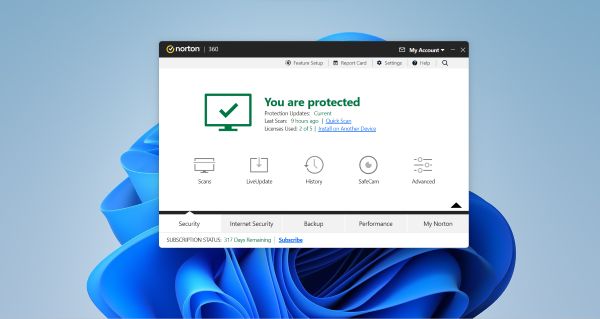

Norton 360 review

Norton 360 software does what it says on the tin. It allows you to not only scan for nasty malware and viruses but let you monitor when there is suspicious activity with your credit card, social media account, email, gamer tag and any other personal details.

I’ve used Norton 360 in the past (you can read our last review of it here) and have been using the latest version of Norton 360 for about three months now. The latest iteration has what is called financial monitoring. Which is where the software monitors your financial transactions, be it bank accounts, home loans or investments, then alerts you if there is any suspicious activity, and identity protection which monitors your personal data to protect against identity theft.

Norton uses a platform called Yodlee and being a naturally cautious person when it comes to forking out my bank account details. I did some sleuthing about the company. Yodlee is an online banking solution provider that links to your nominated account and is used by financial focused companies such as Xero and banks. – And it sounds like I’m using it anyway and never knew I did: Apparently it is the software that facilities transferring money between bank accounts and to pay bills online.

I already let Norton monitor for unusual credit card activity, and all the major New Zealand banks were on the set up screen so it seemed legit. So why was I so cautious to provide my bank account login details? I guess because, deep down, my untrusting side thought it might be a huge security breach.

I mean, banks tell you ad naseum not to provide account login details to any external party and here I was contemplating providing it to a software company that I didn’t really know anything about, but seemingly already allowed access to my bank details when I did transactions.

My mind was a mess.

I mulled it over for a few days and the day I decided to throw caution to the wind and provide my bank account details to allow Norton’s financial monitoring to monitor my credit card account for suspicious activity – my bank detected fraudulent activity on my credit card, apparently from some company in Iceland and was set up as recurring payment. That didn’t sound good.

Two phone calls shortly afterwards to my bank and my card had been cancelled and a new one ordered, but it now meant I couldn’t test out the financial monitoring functionality as I didn’t have a credit card. Murphy’s Law, right?

Hindsight is a wonderful thing and perhaps if I had activated the financial monitoring functionality earlier it might have picked up the fraudulent activity sooner. It looks like the bank picked up the fraudulent activity before any money was taken. But I wonder if I hadn’t been so cautious, I wouldn’t have had to go through the rigmarole of blocking then getting a new card.

Overall, Norton’s offer a great product.

The antivirus does its job, as does the VPN, but my main gripe – as it has been with past iterations – is how aggressively it tries to get you to upgrade to a higher tier version of the product that isn’t included in the base product. Such as the ability to fix system problems picked up after a system scan. Norton will fix those issues for me, but for an additional charge if I upgrade.

That’s not what frustrates me, though. What frustrates me is that even if I click “no” to the upgrade option. It continues to ask me if I’m sure I don’t want to sign up for the upgrade option. Norton, I’ve said no, please take that as my final answer.

Ultimately, in this day and age when cyber security is paramount, I reckon it’s worth having Norton’s – or any form of antivirus software – to keep you safe online. If only I had heeded my own advice a little earlier.